- Personal

- Business

- Savings & DepositHigh Interest Rate

- LoanInstant Approval

- SMEGrow your business together

- Wingbiz+ PayrollExperience ZERO processing payroll fee!

- Money TransferSend money to friends and family around Cambodia.

- PaymentPay your bills quickly, conveniently, and securely

- ESCROWTrust and security in business deals

- Wing Merchant AppManage your shop with ease

- Become Wing AgentRegister online from anywhere!

- WingmarketCambodia’s digital business landscape.

- Cheque BookSecure and convenient

- Wing Bank App

- App OverviewSend, Spend, Save Smart

- AccountMore than just Banking account

- Local TransferSend money to friends and family around Cambodia.

- Phone Top UpRecharge your phone

- KHQRInstant cross-bank QR transfers & payments

- World TransferMoney transfer services catering locally and worldwide

- Code To WingReceiving money anywhere at any time

- Cash-InDeposit quickly and easily with 11000 Agents Nation Wide

- LoanWing Digital loan

- Bill PaymentPay your bills quickly, conveniently, and securely

- Cash-OutWithdraw quickly and easily with 11000 Agents Nation Wide

- WingpointsPay with Wing Bank to start collecting Wingpoints!

- Self Services

- 24/7 ATM & CRMBanking at anytime

- Wing AgentsPerforms a full set of services

- Wing Bank BranchesStandard and Extend Hour to offer best banking experience

- Wing Bank TowerAn architectural masterpiece and symbol of innovation

- WingmallCooler & Better

- Coffee HubThe taste of success

- WingPayMerchant retail payments

- Support

- News

- Promotions

- Careers

- About Us

- CSR

- Personal

- Business

- Savings & DepositHigh Interest Rate

- LoanInstant Approval

- SMEGrow your business together

- Wingbiz+ PayrollExperience ZERO processing payroll fee!

- Money TransferSend money to friends and family around Cambodia.

- PaymentPay your bills quickly, conveniently, and securely

- ESCROWTrust and security in business deals

- Wing Merchant AppManage your shop with ease

- Become Wing AgentRegister online from anywhere!

- WingmarketCambodia’s digital business landscape.

- Cheque BookSecure and convenient

- Wing Bank App

- App OverviewSend, Spend, Save Smart

- AccountMore than just Banking account

- Local TransferSend money to friends and family around Cambodia.

- Phone Top UpRecharge your phone

- KHQRInstant cross-bank QR transfers & payments

- World TransferMoney transfer services catering locally and worldwide

- Code To WingReceiving money anywhere at any time

- Cash-InDeposit quickly and easily with 11000 Agents Nation Wide

- LoanWing Digital loan

- Bill PaymentPay your bills quickly, conveniently, and securely

- Cash-OutWithdraw quickly and easily with 11000 Agents Nation Wide

- WingpointsPay with Wing Bank to start collecting Wingpoints!

- Self Services

- 24/7 ATM & CRMBanking at anytime

- Wing AgentsPerforms a full set of services

- Wing Bank BranchesStandard and Extend Hour to offer best banking experience

- Wing Bank TowerAn architectural masterpiece and symbol of innovation

- WingmallCooler & Better

- Coffee HubThe taste of success

- WingPayMerchant retail payments

- Support

- News

- Promotions

- Careers

- About Us

- CSR

Wing Online

Mastercard

Enjoy total control of your money anywhere in the world!

Wing Virtual Mastercard

Virtual cards can be used for any purchase — just like a physical card. You can use the Virtual Mastercard to plan your holiday, book tickets, order food, shop online and even start your online business. Get it for FREE* on Wing Bank App now!

Do you like shopping Online? Make transactions easily anywhere in the world with Wing Virtual Mastercard.

How to Apply

Get your FREE Wing Bank account now with valid documentation and follow these easy steps to instantly use your Virtual Mastercard:

- Have Wing Bank account and download Wing Bank App, then click on “My Account”, after that click on (+) to add new card “Online Mastercard”.

- Choose which Wing Bank account to link to your card, complete your information, then click “Create Mastercard”

- Set up your Virtual Mastercard PIN then your card is successfully created

- Enjoy using your Virtual Mastercard!

*Note:

Eligible only for full KYC customers who have valid document such as:

- National ID Card

- Passport (Valid visa included for foreigner)

Visit the nearest Wing Bank to upgrade your account.

What sets Wing Online Mastercard apart?

- It's an instant self-issuance Online Mastercard

- No waiting time required

- Start shopping anywhere in the world right away

How to create your Wing Online Mastercard

Service Fee

Service Fee

|

Wing Virtual Mastercard |

|

|

Fees and terms |

Standard |

|

Card Creation*/Issuance Fee |

FREE** |

|

Minimum Balance require |

$0*** |

|

Currency |

USD Only |

|

Daily Purchase Limit (up to) |

$5,000/Day |

|

Daily Purchase transaction Limit |

Unlimited |

|

Virtual Card Expiry |

5 Years |

|

Monthly Maintenance Fee per card (up front) |

$0.50 |

|

Other Fee |

|

|

Purchase in non-USD - per txn |

2.5% for currency conversion |

|

Decline transaction fee/txn |

$0.40 |

|

Online Purchase/txn |

Free |

|

Applicable to create through |

Wing Bank App |

Notice:

* Card Create allow 10 virtual cards per unique user and eligible for Full KYC user only

** free for 3 cards issuance fee, from 4th-10th card create, issuance fee: $1/Card

*** To link with Wing Virtual Mastercard, your Wing account must have a balance at least $0.50 to cover the Monthly Maintenance Fee (upfront fee)

Card Expired

How to Renew Wing Virtual Mastercard

Once your card becomes grey in Wing Bank App, it simply means your card is already expired. To renew your card, please follow the steps same as above stage on How to Apply:

You can create a new Wing Virtual Mastercard by yourself with your current Wing Account on the Wing Bank App. You will get a new Wing Virtual MasterCard with a new card number.

How to Delete Card Expired

This enhancement is to allow customer to close or delete card or remove card from their account

In case customer confuses to use those deactivate cards for any transaction, declined transaction may occur and charge declined fee to Wing

Therefore, this function “Close Card” to remove the card that stop using from linked account.

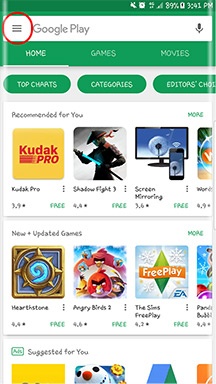

Connect Wing to Android Play Store

Whether it's for gaming, listening to music or shopping, enjoy quick payment method with Wing.

- 1Whether it is for gaming, listening to music or shopping , enjoy a quick payment method with Wing.

- 2Click “Account”

- 3then select "Payment methods"

- 4Tap "Add credit or debit card"

- 5Enter your Wing Online Mastercard number then hit "Save"

- 6Now you can enjoy shopping on the Android Play Store with Wing Online Master Card.

Set up Apple Pay with Wing Online Mastercard

Get music from iTunes, shop till you drop and pay your in-app purchases on your iPhone with Wing

- 1Set up Apple Pay on your iPhone

- 2Go to the Wallet app and tap "+" on the upper right corner of your screen

- 3Add your Wing Online Mastercard details

- 4Wing will verify and approve your application

- 5After the verification, you can start using Apple Pay with Wing

Connect with PayPal

PayPal has partnerships with huge online merchants worldwide like eBay and Amazon. Match PayPal's large online payment processing with Wing Online Mastercard's safe and easy spending.

- 1In your PayPal account, go to “Settings”

- 2Choose "Banks and Cards" to go to your payment methods

- 3Add a new card

- 4Select "Debit or credit card"

- 5Choose Mastercard and enter your Wing Online Mastercard information

- 6Enter your billing address

- 7Click "Link Card" and wait for the verification from PayPal

- 8Review your card in the "Banks and Cards" menu

Pay at Taobao using Wing Online Mastercard

The widest range of products is now at your fingertips as you pay with your Wing Online Mastercard at Taobao, China's biggest consumer-to-consumer e-commerce platform.

- 1At the Payment page, select “International Credit Card”

- 2Enter your Wing Online Mastercard number

- 3Enter the required information

- 4Confirm the payment

Connect with Alibaba

Grow your business with China's most recognized e-commerce giant, Alibaba, and Wing's safe and secure Online Mastercard.

- 1Go to the Bank Account homepage and click “+Link Bank Account”

- 2 Enter your Wing Online Mastercard details and other required information then submit online

- 3Alibaba will send two small transfers within 2-3 working days as part of the verification process

- 4When you receive the transfers, click “Verify Now” and enter the two small transfers into the verification page

Connect with Alipay

Be on top of the mobile payment era with Alipay's quick and convenient online payment processing and Wing Online Mastercard.

- 1Go to this page:

- 2Enter your Wing Online Mastercard details and other required information

- 3Alipay will hold one cent in your card for verification

- 4Click “Save the card”

Connect with Facebook Business

Paying Facebook ads is now simple and easy with Wing Online Mastercard. Connect your Wing account to Facebook with these steps.

- 1Open your Facebook app

- 2Head to the Payment Settings

- 3Click "Add Payment Method"

- 4Enter your Wing Online Mastercard details and wait for the verification

- 5After the verification, you can start paying ads with your Wing account

Online Mastercard Terms & Conditions

Please read these terms and conditions herein carefully before using Online Mastercard of WING, as they shall apply to all transactions involving the use of this card.

Most importantly, cardholder is deemed to have accepted unconditionally any and all terms and conditions listed hereunder and shall be bound by them once the WING Online Mastercard is used. In these terms and conditions the words listed and define under section 1 Definitions gives all description about the card, the account, interest, fees and other charges in relation to this terms and conditions of using the Online Mastercard and every detail in relation to these terms and conditions of using this Card are as follow:

Terms & Conditions:

1. Definitions

| Agreement | means the agreement between Cardholder and WING which includes these terms and conditions. |

| WING, “We” or “us” | means Wing (Cambodia) Limited Specialised Bank whose head office is at #721, Preah Monivong Blvd., Sangkat Beung Keng Kang 3, Khan Chamkar Mon, Phnom Penh, Kingdom of Cambodia. |

| Online MasterCard/ Card | means a virtual debit card from a payments system by Mastercard issued and used as a means of payment presented in a particular currency in a form of a card. This card exists online or in the internet/digital and no actual plastic card is issued. |

| Card Purchase | means any transaction whereby the Card is used as payment for goods and/or services at online Merchant(s). |

| Customer Due Diligence | means personal documentation supplied by Cardholder to WING to confirm your name, profile information and current address in order to meet our regulatory requirements. |

| Merchant | means an online supplier of goods and/or services which has agreed to accept the Card as payment for goods and/or services. |

| Website | means www.wingmoney.com |

| Cardholder/You/Your | means the subscriber of WING Payment Services. |

| Agent | Wing Cash Xpress who is responsible for providing all Wing services to Wing’s customers such as money transfer, phone top up, bill payment, opening Wing account, deposit (cash in), withdrawal (cash out) and other Wing products and services. |

| Authentication data | unique Cardholder’s name (login), password and PIN-code used to access the Service from the Internet and/or through the Terminal and carry out any operations within Cardholder account balance. Authentication data shall be given to a cardholder at the moment of a cardholder’s registration in the Service; at that Service Operator shall be entitled, as provided for therein, to enforce the change of the password and/or PIN-code by prompt notice to a cardholder sending to him/her an SMS message to a subscriber number specified by a Cardholder when getting registered in the Service. |

| Subscriber number | a telephone number, given to a cardholder by a cellular communication operator at the moment of a cardholder’s connection to the network of a cellular communication operator, definitely identifying a person who entered with such cellular communication operator into mobile communication service contract. |

| Self-service automaton (SSA) | a kind of terminal providing payments receipt from natural persons in self-service mode. |

| Payment System | Payment system is referred to system of Mastercard Worldwide or other entities provide license to issue and accept the payment card. |

| Cardholder membership | Any person to whom an online card is issued by WING including any renewal and replacement. |

2. Subject of the contract

2.1 The subject of the Contract made by you by accession to this Offer by doing contracting bargains provided for with this Offer shall be providing of services by “WING” to “You” on the Use of Service with the purpose to make settlements by a Cardholder in favor of Recipients of Payment.

2.2 With the purpose of duly providing by WING of services under the Agreement subject to making thereof on the terms of this Offer, a Cardholder shall undertake to register cardholder account prior to the WING fulfills its liabilities under paragraph 2.1. Therein, in the order provided for with Section 3 therein, and increase the cardholder account Balance to the amount at his/her discretion.

3. Registration and activating your Card

3.1 The use of the Card is subject to terms of this Agreement as may be varied by us from time to time. The current version of the terms and conditions is available on the Website. Usage of the Card constitutes your acceptance of these terms and conditions.

3.2 To apply for your Card you must be at least 16 years old and living in Cambodia.

3.3 We will require a name, date of birth, national ID/ passport #, mobile phone number, link Wing account, and email address when applying for a Card.

3.4 You may also be asked to submit documentation to us for purposes of identification in accordance with our Customer Due Diligence requirements. We may also use electronic methods to satisfy our Customer Due Diligence requirements.

3.5 You will receive your Card once payment approval has been completed. Details will be sent to you online and by a text message to the mobile phone number you provide (subject to successful identity verification) and/or notification pop up through web or App. Please refer to the Website for all Card loading options.

3.6 The Cardholder Account in the Payment Service System is created as follows:

3.6.1 Register using Software Application:

- a. choose the application Wing at App Store, Play Store and download it for free to your mobile device;

- b. enter your mobile phone number chosen in the form given; the mobile phone number specified by the Cardholder during signing up will be used as login (Cardholder name) when using this Payment Service operations;

- c. as soon as SMS message is received by the cardholder containing all Authentication data enter this data in the registration form.

- d. Follow the step guide in App and complete information as require << Online Mastercard >>.

3.6.2 Registration through Website:

- a. enter the electronic address of the website used for WING in the URL bar of the web browser: www.wingmoney.com

- b. enter your mobile phone number given in international format in the registration form; the mobile phone number specified by the Cardholder during sign up will be used as login (Cardholder name) when using the Payment Service.

- c. as soon as SMS message is received with all Authentication data, enter the data in the registration form.

- d. Follow the step guide in App and complete information as require << Online Mastercard >>.

Please note that to get the Card you are required to have Wing Account.

4. Procedure, terms and cost for using your Card

4.1 The Card may only be used in Merchant(s) websites accepting Mastercard. Merchant(s) may change from time to time.

4.2 You shall be responsible for ensuring the correctness and accuracy of all purchases made with the Card.

4.3 We will immediately debit the amount of all Card Purchases from the balance of your Card. If you attempt to spend more than the Card balance using only the Card, your transaction will be declined.

4.4 You must not use the Card:

- after any notification of its withdrawal is given to you;

- after this Agreement has been terminated; or

- as payment for any illegal purchase.

4.5 You cannot stop a Card Purchase after it has been authorized.

4.6 We will not issue Card statements. You can obtain your Card balance or obtain information about previous Card Purchases by logging into WING account and check for transaction or by calling to Customer Service through 023 9999 89. You are responsible for monitoring your Card balance and for ensuring that there are sufficient funds on the Card at all times to pay for Card Purchases. The up to date Card balance and any recent Card transactions will be available to view the same day.

4.7 If at any time you become aware of an unauthorized debit transaction made using your Card you must notify WING immediately by calling to our Customer Service 023 9999 89 without undue delay and, in any event, within 30days of the debit date of the transaction.

4.8 Once you have notified us of an alleged unauthorized or incorrectly executed transaction on your Card, we will promptly investigate your claim. In some cases we may ask you to give us further information about the transaction (for instance, to enable us to confirm that the transaction was properly authenticated). You confirm that you will cooperate with the police or other enforcement bodies if requested to do so.

4.9 Where it is established to our reasonable satisfaction that the transaction was not authorized by you, we will (subject to Clause 4.10 and 4.12 below) refund the full amount of the transaction.

4.10 We reserve the right to refuse a refund under Clause 4.9 where you fail to notify us within 30days of the date of the debit transaction.

4.11 We reserve the right to debit from your Card the amount of any refunds paid to you where, upon further investigation, it is subsequently established that you are not entitled to a refund. If there is insufficient balance on the Card to debit the amount of any refunds paid to you in circumstances where you are not entitled to a refund, we reserve the right to take all reasonable steps (including legal proceedings) to recover from you the amount of any such refunds together with any fees, charges or expenses that we have incurred.

4.12 We reserve the right to withhold refunds if, and to the extent that, we can show you have failed to comply with any relevant provisions of this Agreement.

4.13 WING will not be liable for defects in any goods or services paid for using the Card. Any queries or complaints about such goods or services should be addressed to the relevant Merchant(s).

4.14 In case of termination of the agreement to render mobile communication services concluded between the Cardholder and the mobile network operator followed by annulment of the mobile phone manager specified by the cardholder when signing the Cardholder Account in the Service, the Cardholder is obliged to cease using services of the system based on Authentication data that include the above said mobile phone number and terminate the agreement concluded by the Cardholder by accepting this Offer through making licensed transactions provided by this Offer.

4.15 Prior to the date when the Cardholder submits the new mobile phone number to the WING either prior to receipt of the written notification from the Cardholder on the agreement termination, WING is entitled to disable access to services for the Cardholder based on application of Authentication data that include the annulled mobile phone number.

4.16 The rights to funds on the balance of the Cardholder Account are confirmed by submission of the corresponding letter by the Cardholder with the copy of the agreement concluded between the Cardholder and mobile network operator certified by the WING attached to provide mobile network services that allow the Cardholder the privilege to use the mobile phone number specified by the Cardholder when signing to the system, and copy of the passport or any other document to acknowledge the Cardholder’s identity.

4.17 In case when the Cardholder fails to submit documents specified in the clause 4.16 of this offer within Thirty (30) calendar days since the date of the corresponding notification sent to WING, the letter is entitled to terminate the Agreement concluded on terms of this Offer in this sole discretion.

4.18 Any Online Mastercard transaction amount presented to WING for authorization or for payment is subject to be debited from the account but it is not a settled amount for the transaction unless it is same as amount billed from Payment System. WING will extra debit or credit certain amount from or to your Wing account regarding to any transaction amount which is unbalance between authorization amount and billed amount from Payment System for transaction settlement. WING may credit any debited amount for unsuccessful transaction which is not billed to customer’s Online Mastercard account for payment after 30 (fifty) calendar days from the transaction date. In addition, WING might reduce the amount of credit time from 30 (fifty) calendar days to 15 (fifteen) calendar days if WING receives a written request from cardholder, confirming that the transaction is incompletely performed. However, cardholder is still liable for any and all unsuccessful transaction if it is posted to WING afterwards for settlement.

5. Cancellation of your Card

5.1 You have a legal right to cancel your Card up by notifying to WING.

5.2 If you cancel your Card for whatever reason, we will immediately block your Card so it cannot be used. You will not be entitled to a refund of money you have already spent on transactions, or pending transactions or any fees due for the use of the Card before the Card is cancelled.

5.3 You can cancel your Card by contacting our customer service through 023 9999 89 or deactivating it on your Wing App.

5.4 If at any time:

- You are in breach of any of the terms of this Agreement; or we have reasonable grounds to suspect fraud, theft or dishonesty; we will be entitled to take such steps as we consider reasonably necessary to restrict your right to use the Card, which, without limitation, shall include, without prior notice to you, refusal to authorize a purchase, suspension, withdrawal or cancellation of your Card.

- If we do this, we will tell you as soon as we can or are permitted to do so after we have taken these steps.

5.5 Your Card number will be valid for 1-2 years based on the type of your Card used. In case the card has expired you can self –issue a card from your Wing App.

6. Confidentiality and Safety

6.1 You shall undertake to take any necessary measures as to the safety and protection of information and documents that are exchanged within the Service or that are available to you regarding Use of Service.

6.2 You shall undertake to independently take all necessary measure to keep confidential, prevent any unauthorized use and to protect his/her Authentication data from any unauthorized access by third parties. You shall not inform your Authentication data to any third parties.

6.2.1 With the purpose to prevent from any unauthorized use and to protect own Authentication data from any unauthorized access by third parties using any remote access channels, you shall undertake to independently install on technical devices used by you to access the Service (except terminal type devices, belonging to Agents) an antivirus software and to maintain its timely updating. If non-use by a Cardholder of any antivirus software, use of unlicensed (illegally purchased) antivirus software or late updating of threat signatures result in acquiring by third parties of an unauthorized access to a Cardholder’s Authentication data, WING shall not be responsible for any damage caused to cardholder account (including making of payments at the expense of assets available on the cardholder account Balance) through the Service using a Cardholder’s Authentication data until the WING receives a due notice.

6.3 WING shall undertake to observe the confidentiality regarding personal details of you as well as information on you became known to WING in connection with the Use of Service by your, except when:

- Such information is public;

- Information has been disclosed at the request or with permission from you;

- Information is subjected to be presented to a Cardholder’s contracting parties in the volume necessary to fulfill the contract concluded on terms of this Offer;

- Information requires to be disclosed on the grounds stipulated with legislation or suspected treaties or relative requests of count or of authorized state bodies have been received.

6.4 You shall undertake:

- Not to carry out through the Service any illegal financial transactions, illegal trade, operations on legalization of income obtained criminally, and any other operations in violation of the law;

- To prevent any efforts of illegal trade, illegal financial transactions, transactions purposed to legalization (laundering) of income obtained criminally.

6.5 WING shall reserve the right to refuse a Cardholder to make Payments Using Service by sending an SMS message to your number mentioning the reason of such refusal, including in case of any reasonable doubts in the lawfulness of such actions of a Cardholder. In such case WING shall be entitled to require from you:

- To give additional information on Cardholder’s activity (including documented on paper); in case of refusal to present such information and failure to present thereof within 15 (fifteen) days as of due request to a cardholder to present such documents (information), the Service Operator shall block the cardholder account;

- To present notarized copy of a mobile communication service contract made with cellular communication operator, entitling a Cardholder to use Subscriber number specified by a Cardholder at registration of cardholder account in the Service.

6.6 WING shall undertake to permanently control over the confidentiality of personal details of a Cardholder. WING shall undertake neither make use of nor disclose any information identifying a Cardholder with the purpose not related to the execution and issuance of documents, making requirement or making settlement with a Cardholder. Disclosure of any information may only be in such cases previously notified to a Cardholder at the moment of obtaining of such information from a Cardholder or with a Cardholder’s consent. At that the Service Operator shall be entitled to give other persons an access to information on a Cardholder only if a Cardholder has directly expressed his/her interest in their goods, works or services.

6.7 WING shall be entitled at any time without any additional address notice to a Cardholder, to develop and introduce additional safety measures to Use Service. WING shall place a notice at Website about introduction of such safety measures and actions of Cardholders in connection with introduction of such measure (if applicable).

7. Liability

7.1 In the event that you do not use your Card in accordance with these terms and conditions or we find that you are using the Card fraudulently, we reserve the right to charge you for any reasonable costs that we incur in taking action to stop you using this Card and to recover any monies owed as a result of your activities.

7.2 Like other payment cards, we cannot guarantee a retailer will accept your Card, or that we will necessarily authorize any particular transaction. This may be because of a systems problem, something outside our reasonable control, or because we are concerned that your Card is being misused. Accordingly, we shall not be liable in any event that a merchant refuse to accept your payment or if we do not authorize a transaction, or if we cancel or suspend use of your Card.

7.3 Unless otherwise required by law, we shall not be liable for any direct or indirect loss or damage you may suffer as a result of your total or partial use or inability to use your Card, or the use of your Card by any third party.

7.4 We may restrict or refuse to authorize any use of Your Card in any legal jurisdiction if using the Card is causing or could cause a breach of the Terms and Conditions of this agreement or if we suspect criminal or fraudulent use of the card.

7.5 You must immediately notify WING of the lost, stolen, theft and/or unauthorized use of the Online Mastercard account by verbal or in writing. You may be liable for any and all unauthorized transactions but you shall have no responsibility for any unauthorized use that occur after you notify WING, orally or in writing, of the lost, stolen, theft and/or other possible unauthorized use of your Online Mastercard.

8. Changes to these Terms and Conditions

8.1 We may add to or charge these terms and conditions in accordance with clause 8.2. We may add new fees and charges or change existing fees and charges at any time.

8.2 We will tell you in advance if we add to or change these terms and conditions or if we add new fees or charges or change existing ones. The amount and type of notice that we will give you will follow the laws and regulations that apply at that time. (For example, we may notify you by letter, electronic mail, telephone (including recorded message) or by an advertisement in WING website and Facebook).

8.3 If we change or add to these terms and conditions and you are not happy to accept the changes, you may end this Agreement and close your Card. If you do not ask us to end this Agreement, you are deemed to accept the changes on their effective date.

9. Fees & Charges

9.1 Monthly Fee and Replacement Fee

A non-refundable card annual fee or card replacement fee (refer to Card Services and Fee Charges) as prescribed by WING from time to time shall be debited from cardholder’s Wing account for the use of the Online Mastercard.

9.2 Declined Transaction Fee

Cardholder shall be charged a fee (refer to Card Services and Fee Charges) if any transaction performed by customer is declined due to unavailable balance in the Wing account.

9.3 Dispute and Resolution Fee

If cardholder requests WING to process any dispute transaction, a fee charge per transaction will be incurred and debited from the Wing account. However, WING shall inform you initially about additional fees and other charges which are not listed in Card Services and Fee Charges before proceeding with the case.

9.4 Foreign Exchange Fee (FX Fee)

FX Fee of 2.5% of volume transaction is charged to Cardholder when cardholder purchase goods or service in other than US Dollar currency. (For the update please refer to Card Services and Fee charges).

10. General

10.1 WING will not be liable for any delay or failure in performing any its obligations in respect of the use of the Card where such delay or failure occurs because of any circumstances beyond WING reasonable control.

10.2 The accounts and records kept by WING or on its behalf shall, in the absence of an obvious error, constitute sufficient evidence of any facts or events relied upon by WING in connection with any Card Purchase or matter or dealing in relation to the Card.

10.3 WING may disclose details of the Card to any person acting as its agent in connection with the use or issue of the Card.

10.4 This Agreement shall be governed by and interpreted in accordance with Cambodia Law.

10.5 In case of a language discrepancy between English and Khmer, the English language Terms and Conditions shall prevail.

11. Use of your information

11.1 Considering your application

Online Mastercard is issued by Wing and Wing is the data controller. The personal information which you have provided to us may be used in the manner set out in the Clause 13.

11.2 Use and disclosure of your information

The personal information which are hold about you may be shared with and cross-checked by other business, fraud prevention or credit reference agencies, our suppliers, agents or subcontractors and anyone who introduced you to us:

- To verify your identify and/or address;

- To trace debtor, recover debt, to prevent fraud and money laundering;

- To manage and administer your card; and

- This information will be used by WING so that we may carry out statistical research and analysis, compliance and regulatory reporting and administration in respect of the Card in accordance with the above.

The Customer grants WING and relevant third parties a perpetual, royalty free right to keep a record of the information referred to above.

If you want to receive details of those fraud prevention agencies from whom we obtain, and with whom we may record, information about you, please write to us at the address show in Clause 11.3 below. You have a legal right to these details.

11.3 Your right to information

You have a legal right to receive a copy of the information we hold about you by applying in writing to us at:

Wing (Cambodia) Limited Specialised Bank

No. 721, Preah Monivong Blvd.,

Sangkat Beung Keng Kang 3,

Khan Chamkar Mon, Phnom Penh,

Kingdom of Cambodia

12. Merchant(s)

12.1 It will be necessary in all cases, for a Merchant(s) to obtain authorization to honour the Purchase; this is to ensure that there are sufficient funds on the Card. We may refuse to authorize a purchase at any time if there are insufficient funds on the Card.

12.2 A Merchant may not be able to obtain authorization from us in some circumstances. If this happens we will not be responsible if you are unable to use the Card for a particular Purchase. Furthermore, we will not be liable for the refusal of any Participating Retailer to accept or honour the Card for any reason.

12.3 If a Merchant becomes liable to make a refund to you we will not credit the amount of any refund to the Card; refunds are a matter between you and the relevant Merchant.

13. Communication

13.1 If you have an enquiry relating to your Card, you can use the “Contact Us” facility on the Website. We will deal with your enquiry promptly.

13.2 If you do not wish to enquire in this way you can alternatively call our customer service through 023 9999 89.

14. Merchant Dispute

WING shall not be responsible for those goods and services supplied by any merchant or establishment in respect of any transaction performed by cardholder. Also, WING shall not be liable in any way if any merchant or entity refuses to accept or honor the Online Mastercard for any reason. However, WING may defend and counterclaim (other than tort claims) arising out of the transaction of customer if you have made a good faith attempt but have been unable to obtain satisfaction or solution from those merchant or establishment. In case of any wrong posted or fraud transactions somehow related to this card, WING will support Cardholder to return the claim of transaction amount by initiating chargeback request to acquirer through respective payment system (Mastercard). But in case of this chargeback dispute will be lost based on respective payment system’s rules, WING is not responsible to return any lost amount, Cardholder will absorb the losses.

15. System Malfunction

WING makes no claims or warranties with respect to the equipment or the system and WING shall not be liable for any failure to provide any service or to perform any obligation due to any malfunction of the equipment, the machine, the system or the Online Mastercard, failure of communication lines or any other circumstances beyond the control of WING.

16. Complaints

If you are not satisfied with any aspect of the service offered, please contact our Customer Services on 023 9999 89, via the “Contact Us” link at our Website or write to Customer Services at WING Head office. They will be pleased to help and explain the complaints procedure in more detail. A copy of the Complaints Procedure is available upon request. WING will try and resolve your complaint as soon as possible. Often however, the compliant will need to be investigated. If this is the case, WING will respond to your within five (5) Business Days to acknowledge receipt of your complaint and tell you how long it might be before your complaint is resolved.

Wing Online Mastercard - FAQs

Find the answer here:

Q1. What's Wing - Online Card? And what's its benefit?

A1. Wing - Online Card is new product introduced by Wing for its customers. With Wing - Online Card, users can make payments or purchases exactly the same way as with real card on any online store that displays MasterCard or Visa logo, including Amazon, AliExpress or EBay, iTune, Google Play…etc

Q2. How can I get a Wing - Online Card?

A2. Firstly, you need to have Wing account. Then, you can download Wing Money App and register for virtual Online Card for just a minute.

Q3. What type of cards are available?

A3. There are two types of online card right now, Basic and Standard.

Q4. What's issuance & maintenance fee of Wing - Online Card?

A4. Issuance fee of Wing - Online Card is FREE. Monthly annual fee (USD0.25) for Basic, (USD0.50) for Standard, FREE for the first 6 months of activation.

Q5. Can I create online card with my Cardless account?

A5. Yes, Of course. But you can enjoy only Basic package with limitation max. $100 for any online transaction

Q6. Can I create online card with my Cellcard Reward account?

A6.Yes, sure.

Q7. What is the limit amount per transaction for the Basic and Standard package of online card?

A7. Max. $100 per txn and per day for Basic and Max. $1,000 per txn and per day for Standard package.

Q8. What is the maximum transaction per day for Basic and Standard package?

A8. There is no limitation on transaction, there is limitation on amount spending per day.

Q9. Why do I need to input email /phone number during online card registration when all my detail information are already in Wing Account?

A9. This phone number or e-mail dress is used for any dispute case for any online purchase transaction.

Q10. How do I check my online card transaction?

A10. There is transaction tab on online card screen which lists down all transactions related to your online purchase through virtual account. But transactions are available only last 3 months.

Q11. Can I change my CVV number as I feel someone has known it? How could I secure my account?

A11. You cannot change CVV code right now.

Q12. How to purchase item via Wing - Online Mastercard?

A12. The process of online purchase with virtual card is actually the same to other online transaction using physical Mastercard. User can input card number (16 digits), card expiry date, CVV code, 3D Secure (If required) on Wing virtual card.

Q13. Can I top up my online card with VISA/Master corporate ATM/partners (both local/abroad)? If yes, How much does it cost?

A13. You can't perform money in or out from your virtual account. It's used for online purchase transaction purpose only.

Q14. Can I withdraw money from my Online Card through VISA/Master corporate ATM/partners (both local/abroad)? If yes, How much does it cost?

A14. You cannot withdrawal money from your virtual account right now.

Q15. Is there any hidden fee for customer?

A15. No, all fee charges are disclosed on Wing's website.

Q16. Is Wing - Online Card accepted globally?

A16. Yes, Wing - Online Card is accepted around the world at retail outlets where you see the Mastercard sign. Currently, you can use your card in more than 32 million locations worldwide.

Q17. Who should I call if I have problems with my Wing - Online Card?

A17. If you experience problems with your Online Card either domestically or abroad, you should contact our Wing Care Centre by 023 999 989.

Q18. What should I do if I have lost or had my Online Card stolen?

A18. If your card is lost or stolen, you should contact our Wing Care Centre by 023 999 989 immediately. As a precaution, we suggest that you keep a note of this number separate from your cards/wallet.

Q19. What is difference between normal Wing card and Wing - Online Card?

A19. Normal wing account card is used for local transactions only whereas Wing - Online Card accepted domestically or oversea usage, specifically for online transaction.

Q20. How is currency conversion charged to my account?

A20. When you transact any online purchase with non-USD currency, you need to bear 2.5% of currency conversion of total volume.

Q21. I made a purchase in my local currency, so why was I charged a currency conversion fee?

A21. Wing - Online Card is applicable for USD dollar currency only. So if your Wing account wallet is KHR and you do any online transaction via virtual card, you will be subject to bear 2.5% of currency conversion.

Q22. What is the currency rate for a country I am visiting?

A22. If you would like to know what the latest currency exchange rate is for the country you are visiting, please visit Mastercard's website for the latest currency exchange rates (https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html).

Q23. How can I report an excessive charge for currency conversion?

A23. Thank you for your feedback and we’re sorry you had a bad experience at a merchant that accepts Mastercard. Wing & Mastercard investigate all complaints of deceptive merchant practices. Should you wish to speak with someone directly regarding this communication, feel free to contact Wing Care Center by 023 999 989.

Q24. How do I contact Mastercard Customer Operations Support?

A24. You can contact Wing Care Center by 023 999 989 for any inquiry related to Wing - Online Card.

Q25. How can I dispute a charge?

A25. If you face any dispute case of transaction on Wing - Online Card, Wing will coordinate this directly with other parties for you but you are required to report all related matters if existed.

Q26. Who do I contact if I never received an item that I purchased online or by phone?

A26. If you did not receive an item that you purchased or if you received an incorrect item, you should first contact the merchant to try to resolve the situation. If you can't come to an agreement and you want to dispute the transaction, Wing can help you on this case. Please feel free to reach us by 023 999 989 for detail.

Q27. Why is my purchase declined?

A27. Some reasons as below:

- There is insufficient funds in your Wing account that is linked to the Wing - Online Card. You will need to do cash-in to your Wing wallet.

- Your purchase amount exceeds your chosen daily spending limit.

- Your Wing - Online Card expired.

Q28. If I want to stop using Wing - Online Card, what should I do?

A28. You can deactivate Wing - Online Card by yourself on the App by just going to Deactivate Card option.

Q29. How do I reload balance to my Wing - Online Card?

A29. Wing - Online Card is direct debit from your Wing account (source of fund) so no need to do reload to your virtual account. Every time, you do only online transaction system will deduct from your Wing account directly.

Q30. Can I transfer balance from my Wing - Online Card to another bank's Mastercard/Visa?

A30. You can not transfer money from your Wing - Online Card to others right now.

Q31. What's happened if I cancel my successful transaction which I don't want?

A31. The transaction will be cancelled but you are charged USD0.4 per transaction.

Card Dispute Resolution FAQS

Find the answer here:

Q1. What is a dispute?

A1. There are two categories of disputes. Firstly, it can arise when a cardholder says that he/she did not authorize or particular in transaction. Secondly, a dispute can occur when a cardholder encounters issue with the goods and services purchased.

Q2. What is a chargeback?

A2. A chargeback is the process of card issuing bank to handle a disputed transaction to claim the disputed fund back from merchant for violation of card acceptance procedures or failure to fulfill some of the terms and conditions.

Q3. What are my responsibilities as a cardholder?

A3. Always review the terms and conditions of the sales contract before you sign on the agreement and frequently check the account statement. In case you suspect any unauthorized use of your card, contact your card-issuing bank immediately to block a card.

Q4. How do I dispute a card transaction?

A4. A transaction can be disputed for various reasons as following:

- Not incurred - Unknown transaction billed to the card account

- Double Debit - Charged twice for a single transaction

- Transaction failed or was cancelled

- Service / Goods was not received

- Service / Goods was not as described or defective

To raise a dispute investigation, please contact our Care Centre (+855) 23 999 989 / 012 999 489 or write to us at email carddisputeresolution@wingmoney.com along with supporting documents.

Q5. What should I do before I submit a card payment dispute?

A5. We recommend you contact to merchant directly for first solution. If the matter can be resolved, your account will be credited normally within 15 days. However, if this is not resolved, you may submit a dispute.

Q6. What is the time frame to report a disputed transaction?

A6.A transaction dispute should be raised within 30 days from the date of transaction. Please fill in the dispute form and submit it to us via email carddisputeresolution@wingmoney.com along with supporting documents.

Q7. How long will it take to resolve a card dispute?

A7. Most disputes are resolved within 30-60 days from the date of raising chargeback to merchant bank, although the complex cases could require more additional time.

Q8. Why am I required to fill a dispute form to report transaction dispute?

A8. As per Visa/Mastercard guidelines, in case cardholders want to raise a dispute, you should fill in dispute form mentioning the details of the transaction which will enable the bank to investigate with the respective merchant or acquiring bank.

Q9. How will I come to know that the dispute is resolved?

A9. We will immediately phone or email to notify you about the outcome of your dispute. You also can contact to Care Centre via phone number (+855) 23 999 989 / 012 999 489 or our international card dispute team by email to carddisputeresolution@wingmoney.com

Q10. My card has got debited for an unknown transaction - what should I do?

A10. If you observe unknown transactions, this may potentially be a fraudulent transaction. Please immediately block your card via Wing Mobile App or you may report to our Care Centre to block a card to avoid further unauthorized transactions. Then log a complaint with us to investigate the suspicious transaction.

Q11. What should I do if my card account got debited twice?

A11. If your card account is debited twice for a single transaction, we recommend cardholder directly contact to the merchant for first solution. In case there is no solution, please contact our Care Centre to raise a dispute.

Q12. What should I do if goods or service was not received?

A12. If the merchant fails to deliver goods or services at the agreed date, we recommend cardholder directly contact to the merchant for first solution. If there is no solution, the cardholder can file a dispute. The required information or documents may need including description of merchandise, expected date of receiving goods, and other necessary documents.

Q13. Can I dispute a transaction if I am not satisfied with the quality of the product/service?

A13. This depends on the sales agreement between the cardholder and the merchant. In case you made an online purchase and the merchandise you received was not as described or damaged, you can file a dispute. However, you should contact and resolve the dispute with the merchant to either get an exchange or a refund upon returning the merchandise.

If the merchant refuses, you can fill in the dispute form and provide documentary proof that the wrong or defective product was delivered in order for the bank to initiate a chargeback.

Q14. I'm expecting a refund from the merchant. How could I check the refund?

A14. It may take up to 15 days for the refund to reflect in the card account. If the refund is not credited in 15 days, please fill in dispute form and submit it to us via carddisputeresolution@wingmoney.com along with supporting documents for further investigation.

Q15. How can I prevent my card from fraud?

A15.

- Keep your card in a safe place and don’t let other people use your card

- Never provide card information over social media

- Never share your card details or PIN with others

- Always keep your card in sight when you’re paying for things

- Keep an eye on your account for payments or notification on banking apps you don’t recognize.

- If you don't recognize the transaction, report it to the bank immediately

- Only communicate with the bank through official website or secure channels with password