Some Things Are Better Together

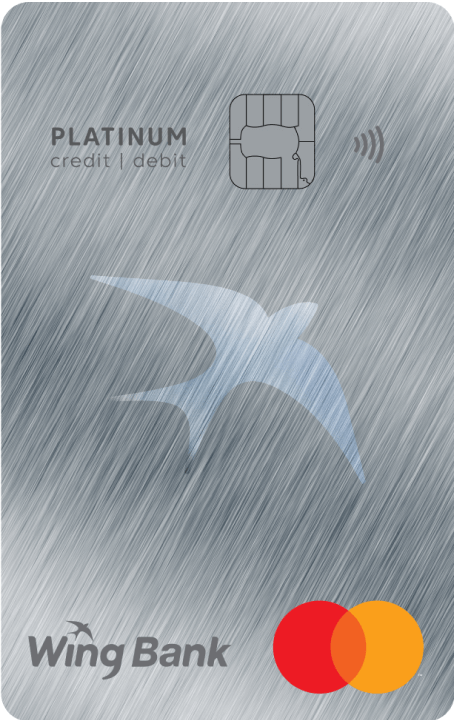

Introducing Wing Bank’s Mastercard One Card - Cambodia's 1st credit and debit card rolled into one! Now there’s no need to choose.

Enjoy the control and convenience of a credit card, paired with the financial flexibility and perks of a debit card in One card.

- Numberless design crafted with recycled materials

- Priority customer support

- 55 days of no interest rate for your purchase transactions

- Access to airport lounge

- Up to $1,000,000 travel insurance

- Up to $50,000 credit limit

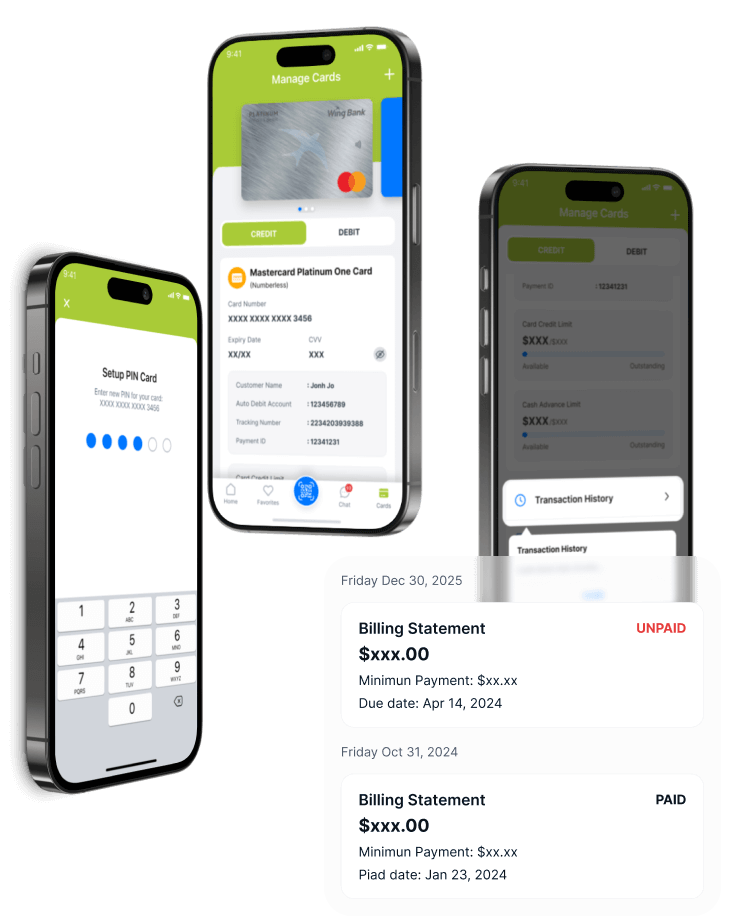

Manage Your Card a Simple Way Through The Wing Bank App

Reset Your PIN

Set Your Payment Terms

Check your bill statement

Choose Your Card Today!

CREDIT and DEBIT

Mastercard Platinum One card

| Credit | Debit |

| Worldwide Airport Lounge Access: Enjoy 8 Visits Per Year Through the DragonPass Network |

|

| Luggage Loss, Flight Delay, and Cancellation Insurance: Coverage Up to $3,000 | |

| Travel Insurance Coverage: Up to $1,000,000 | |

| Global Medical Insurance Coverage: Up to $500,000 | |

| Exclusive Wing Bank Premium Lounge Access | |

| Maximum Credit Limit: $50,000 | Cash withdrawal limit amount at ATM per day: up to $50,000 |

| Cash Advance: Up to 50% of Your Credit Limit | Cash In/Cash Out: Available Nationwide at WCX Locations |

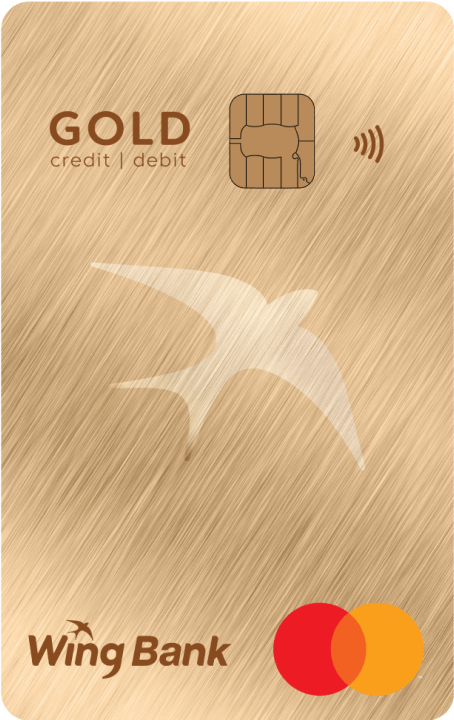

CREDIT and DEBIT

Mastercard Gold One Card

| Credit | Debit |

| Worldwide Airport Lounge Access: Enjoy 2 Visits Per Year Through the DragonPass Network |

|

| Luggage Loss, Flight Delay, and Cancellation Insurance: Coverage Up to $1,500 | |

| Travel Insurance Coverage: Up to $500,000 | |

| Global Medical Insurance Coverage: Up to $250,000 | |

| |

|

| Maximum Credit Limit: $5,000 | Cash withdrawal limit amount at ATM per day: up to $5,000 |

| Cash Advance: Up to 50% of Your Credit Limit | Cash In/Cash Out: Available Nationwide at WCX Locations |

Fee Charge Mastercard Gold One Card

| Type of service | Description | ||

|---|---|---|---|

| Credit | Debit | ||

| Card Annual Fee | Primary | USD 50 | |

| Supplementary | USD 10 | ||

| Duration of expiry | 5 years | ||

| Cash advance interest per month | 2% | N/A | |

| Purchase interest per month | 1.50% | N/A | |

| Cash advance or cash withdrawal fee at Wing Bank’s ATM per transaction | 2% of amount withdrawal, minimum USD 5 | Free | |

| Cash advance or cash withdrawal fee at other bank's ATM/POS per transaction | 2% of amount withdrawal, minimum USD 5 | ||

| Late payment charge fee | 5% of the minimum repayment amount | N/A | |

| Purchase, cash advance, or cash withdrawal fee in non-USD per transaction | 2.5% for transaction amount | ||

| Transaction decline fee at Wing Bank or other bank's ATM/POS/Online per transaction | Free | ||

| Balance inquiry fee at other bank's ATM/POS/eCom per transaction | USD 0.50 | ||

| Card replacement fee per time | USD 10 | ||

| PIN change fee per transaction | Free | ||

Fee Charge Mastercard Platinum One card

| Type of service | Description | ||

|---|---|---|---|

| Credit | Debit | ||

| Card Annual Fee | Primary | USD 250 | |

| Supplementary | USD 50 | ||

| Duration of expiry | 5 years | ||

| Cash advance interest per month | 2% | N/A | |

| Purchase interest per month | 1.50% | N/A | |

| Cash advance or cash withdrawal fee at Wing Bank’s ATM per transaction | 2% of amount withdrawal, minimum USD 5 | Free | |

| Cash advance or cash withdrawal fee at other bank’s ATM/POS per transaction | 2% of amount withdrawal, minimum USD 5 | ||

| Late payment charge fee | 5% of the minimum repayment amount | N/A | |

| Purchase, cash advance, or cash withdrawal fee in non-USD per transaction | 2.5% for transaction amount | ||

| Transaction decline fee at Wing Bank or other bank's ATM/POS/Online per transaction | Free | ||

| Balance inquiry fee at other bank's ATM/POS/eCom per transaction | USD 0.50 | ||

| Card replacement fee per time | USD 15 | ||

| PIN change fee per transaction | Free | ||

Document Requirements

Mastercard Gold One Card (For Unsecured Credit Card)

- Minimum Income (Gross Salary/Profit): minimum USD 200

- Proof of Income:

- Employee: Employment letter including name, salary, position, length of minimum working period, bank statement for the last 3 months, salary slips for the last 3 months, additional documents if any.

- Business Owners: Income statement for the last 1-year period or bank statement for 6 months, house rental contract, business license/patent, and additional documents if any.

- Nationality: Cambodian

- Proof of Identification: Cambodian National identity card or passport

- Foreigners: Residence with valid Visa entry and living period in Cambodia longer than 182 days, employment contract, business registration (currently foreigners can apply only secure card)

- Another Guarantee (Optional): Company/personal guarantee letter

Mastercard Gold One Card (For Secure Credit Card)

- Collateral Type: Must have a Savings/Current Account or Term Deposit with Wing Bank.

- For Term Deposit accounts: At least a 6-month term with rollover conditions.

- Customers are required to settle the outstanding balance before closing the card. If the balance is insufficient, the bank will offset the Term Deposit account for repayment.

- Credit Limit Security: 90% of collateral placement.

- Nationality: Cambodian or foreigner.

- Proof of Identification: Cambodian National ID card or passport.

- Foreigners: Must have a valid Visa entry, a residence in Cambodia for longer than 182 days, an employment contract, and business registration. (Currently, foreigners can only apply for a secured card.)

Mastercard Platinum One Card (For Unsecured Credit Card)

- Minimum Income (Gross Salary/Profit): minimum USD 2,000

- Proof of Income:

- Employee: Employment letter including name, salary, position, length of minimum working period, bank statement for the last 3 months, salary slips for the last 3 months, additional documents if any.

- Business Owners: Income statement for the last 1-year period or bank statement for 6 months, house rental contract, business license/patent, and additional documents if any.

- Nationality: Cambodian

- Proof of Identification: Cambodian National identity card or passport

- Foreigners: Residence with valid Visa entry and living period in Cambodia longer than 182 days, employment contract, business registration (currently foreigners can apply for only a secure card)

- Another Guarantee (Optional): Company/personal guarantee letter

Mastercard Platinum One Card (For Secured Credit Card)

- Collateral Type: Must have a Savings/Current Account or Term Deposit with Wing Bank.

- For Term Deposit accounts: At least a 6-month term with rollover conditions.

- Customers are required to settle the outstanding balance before closing the card. If the balance is insufficient, the bank will offset the Term Deposit account for repayment.

- Credit Limit Security: 90% of collateral placement.

- Nationality: Cambodian or foreigner.

- Proof of Identification: Cambodian National ID card or passport.

- Foreigners: Must have a valid Visa entry, a residence in Cambodia for longer than 182 days, an employment contract, and business registration. (Currently, foreigners can only apply for a secured card.)

How to Apply

Visit your nearest Wing Bank branches, chat with our contact center via Wingchat or call us at 023 999 989 for more information.

Eligible Customer Profile

- Principal cardholder aged 18 years and above

- Supplementary cardholder aged 15 years and above

Wing Bank branches

Wing Bank branches  023 999 989

023 999 989  Wing Chat

Wing Chat