-

Personal

- Accounts & Savings

- Loans

- Cards

- Money Transfer

-

Insurances

Ready to get started? Get the Wing Bank App Now! -

Business

- Account Management

- Payments & Collections

- Business Loan

- Trade Financing

Ready to get started? Get the Wing Bank App Now! -

Company

- The Wing Identity

- Insights & Impact

- Access & Services

- Security Awareness Center

Ready to get started? Get the Wing Bank App Now! -

Wing Bank App

- App Overview

- Payments & Transfers

- Rewards & Lifestyle

- Support & Chat

Ready to get started? Get the Wing Bank App Now!

Accounts & Savings

Cards

Money Transfer

Insurances

Account Management

Payments & Collections

The Wing Identity

Insights & Impact

Access & Services

Security Awareness Center

App Overview

Payments & Transfers

Rewards & Lifestyle

Support & Chat

Quick Links

The Bank for Every Cambodian

Smart services. Real support. All in one app made for you.

Wing Bank App

Self Service

Self Service

24/7 Support

Wing Bank – The Bank for Every Cambodian

Since 2008, Wing Bank has transformed how Cambodians access and manage their money.

Discover All Our Financial Solutions

Explore our full suite of products designed to help you save and invest.

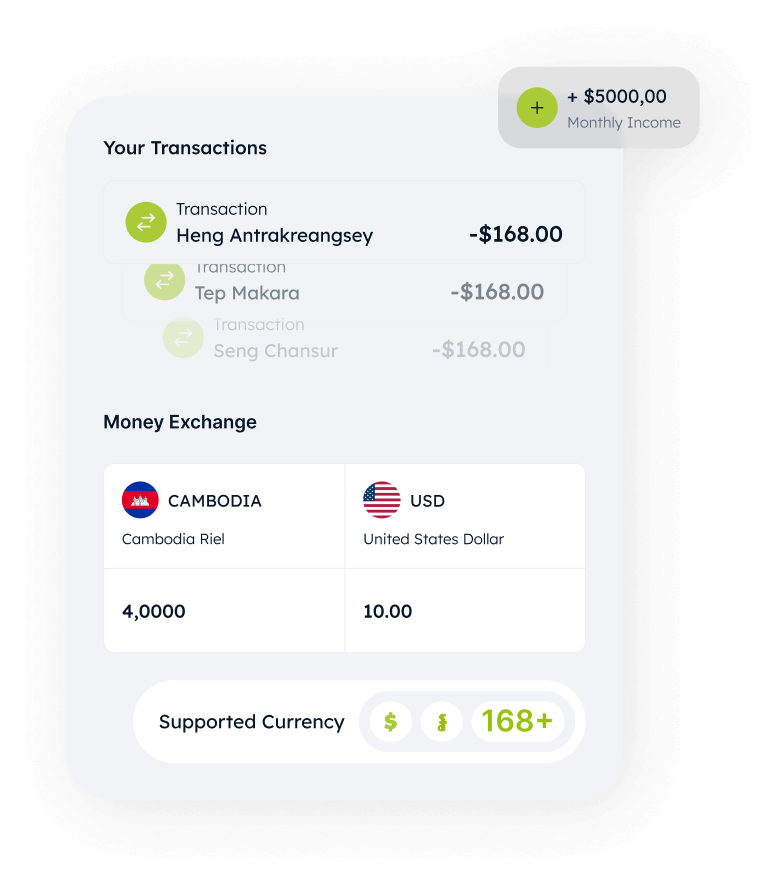

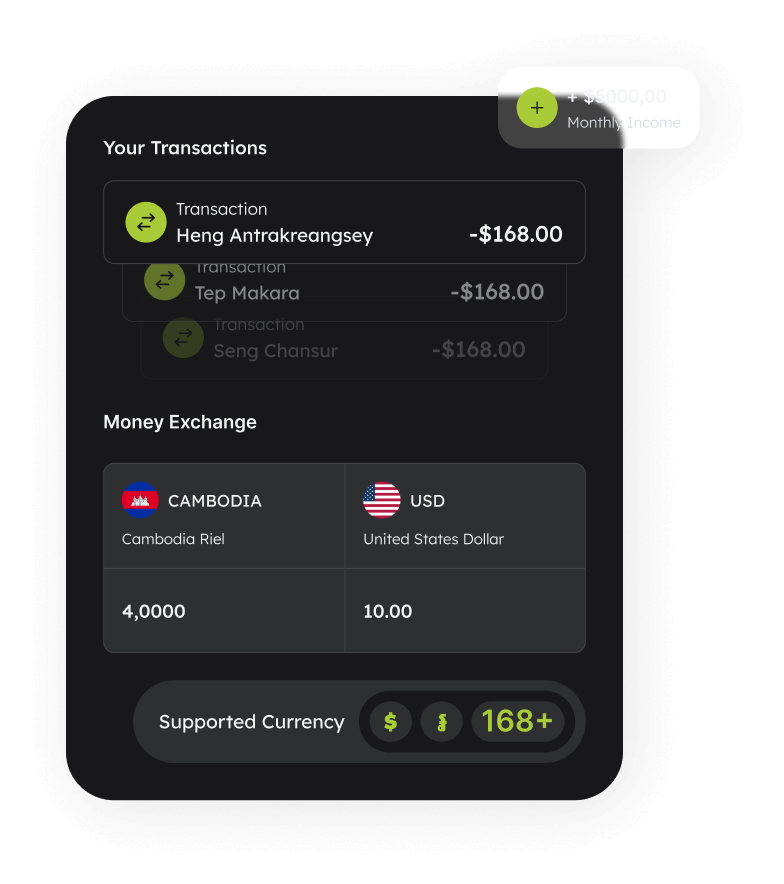

The Wing Bank App

Your phone’s most beneficial financial tool. It truly has so much to offer.

4.4M

Editor’s Choice on the App Store

11.7k+

Apple App Store Reviews

101k+

Google Play Store Reviews

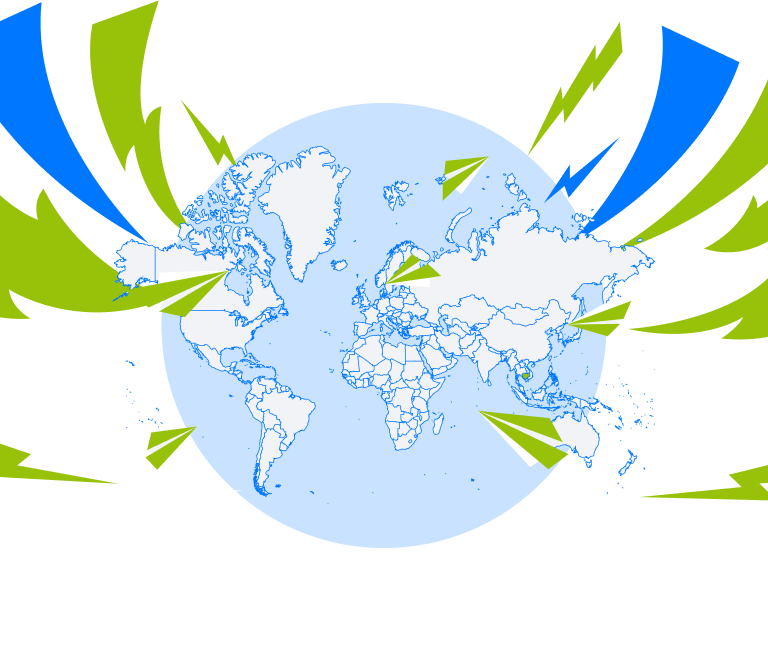

Financial Services for

Everyone, Everywhere

International money transfers to over 165 countries.

Over 10 years of trusted experience in Cambodia and across the globe.

Your Security Is Our Top Priority

At Wing Bank, we use industry-leading security protocols to keep your finances and data safe at all times.

Solutions for Your Every Financial Need.

What Can We Help With?

- Promotions

- News

- Wing for Good

Wing Bank in the news

Join Millions of Cambodians

Digital finance for every Cambodian — simplifying your daily life.

Year of the Fire Horse

The Fire Horse moves forward with energy and purpose. It represents momentum, renewal, and the confidence to build what comes next.